Win more business and bigger jobs with U.S. Bank Avvance®.

Our point-of-sale financing gives your customers the flexibility to say “yes” to home improvement projects, built on the strength and stability of U.S. Bank.

The customer-first financing option.

Your home improvement customers expect flexible payment options to help them budget for large purchases:

- Loan options from $300 - $25,000.

- Repayment terms from 3 to 60 months.

- A fast, secure mobile-friendly application process.

- Customer repayment and servicing through the award-winning U.S. Bank mobile app.

How U.S. Bank Avvance works in Home Improvement:

Qualify customers with pre-approval

Your customers can secure purchasing power with a U.S. Bank Avvance pre-approval.

The customer sees the maximum amount they’re pre-approved for with U.S. Bank Avvance.

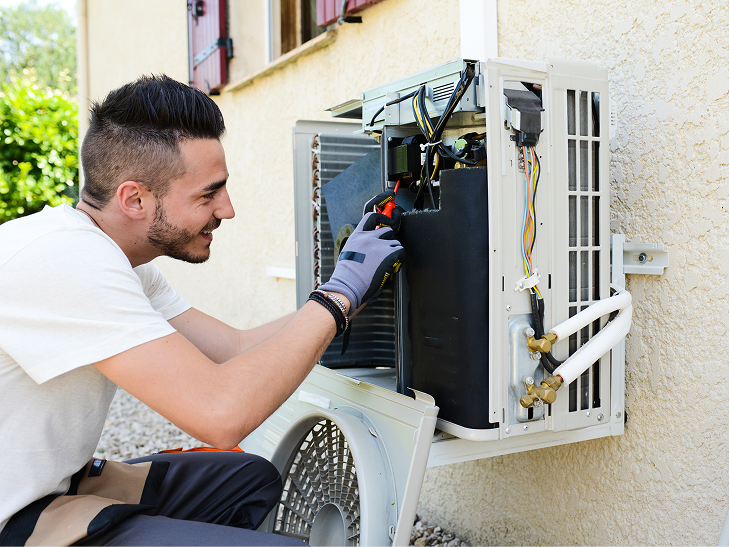

Agree on project price

You work with your customers to agree on a price for the project.

You send the customer an application link, and they apply from their phone to lock in their offer.

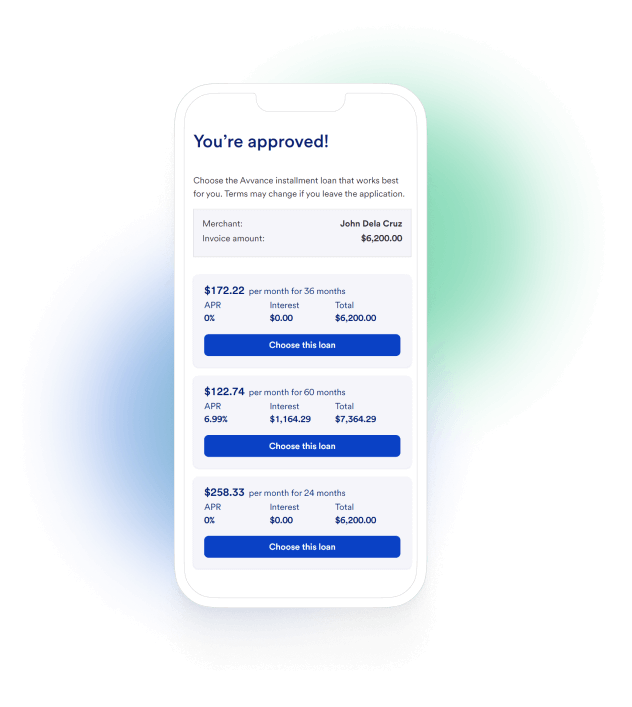

Payments made easy for all

After the customer finalizes their loan, you receive payment within 48 hours.

The customer repays U.S. Bank over time based on the terms of the loan.

Help your customers unlock spending power.

Put your pre-approval link and mobile code wherever your customers find your business. You get a lead notification each time a customer is pre-approved with U.S. Bank Avvance.

Give your customers the option to finance home improvement upgrades with U.S. Bank Avvance.

Customers are looking for more ways to pay.

43%

prefer lending options offered by a bank1

1 in 5

consider financing for purchases $1,000 and higher2

76%

expect a seamless application experience3

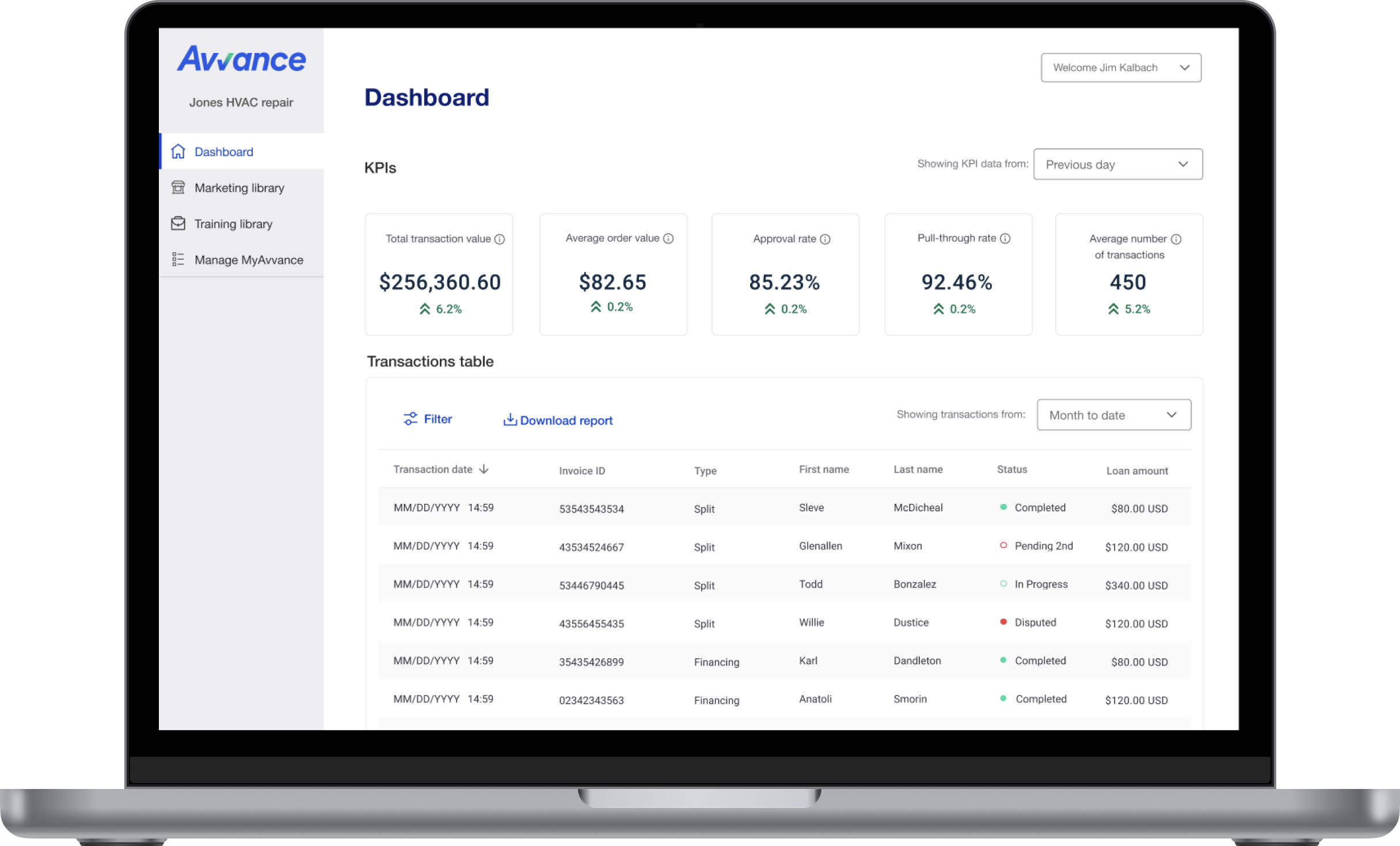

Send invoices, track payments, and review new leads.

The Avvance Merchant Portal is our one-stop web app for your business to manage everything point-of-sale financing.

Download marketing materials, spin through the training library, and give employees the access they need to help you grow your business.

Your business wins with point-of-sale financing.

Turn pre-approval leads into new business

Give your customers more options and great service

Peace of mind with the stability of U.S. Bank

Grow your business with U.S. Bank Avvance®.

Fill out the form and our team will reach out to discuss how to offer point-of-sale financing to your customers.

Frequently asked questions

1 https://news.gallup.com/poll/468053/record-high-put-off-medical-care-due-cost-2022.aspx

2 https://www.mckinsey.com/industries/financial-services/our-insights/banking-matters/us-lending-at-point-of-sale-the-next-frontier-of-growth

3 https://investor.citizensbank.com/about-us/newsroom/latest-news/2018/2018-11-08-123003472